In Mexico, if you are considered as a resident of Mexico according to Mexican Law and meet the conditions about annual tax declaration, you have to do tax return.

Current tax rate is showed as table in Mexican income tax law.

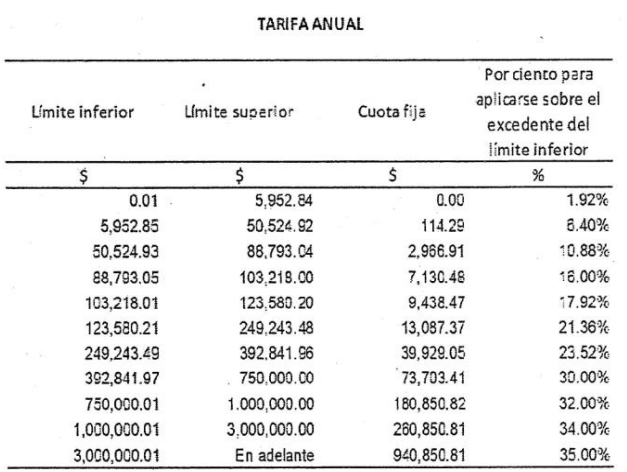

The income tax rate is divided into 11 from 1.92% to 35%.

How can you know your tax rate with this table?

・First of all, you need to check your total income you receive through out the year.

・Secondly, deductions decided by law apply to the total income. (Total income – Deductions)

・Then, tax rates that is in income between the upper and lower limits is applied to the gross income after deductions. (Total income – Deductions)* Tax rate

・Finally, fixed tax is added to the final result of the calculation.

This is rough calculation and just estimate amount.

To know the more detailed amount, please contact us. We can support annual tax declaration.

Leave a Reply